SCHEDULE 14A(RULE (RULE 14a-101)

Information Required in Proxy Statement

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary ProxyStatement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

☒

| ☐ | Definitive AdditionalMaterial |

| ☐ | SolicitingMaterialPursuanttoRule14a-12 |

WhiteHorseFinance,Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, If Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and0-11. |

| ☐ | Fee paid previously with preliminarymaterials. |

WHITEHORSE FINANCE, INC.

1450 Brickell Avenue, 31stFloor

Miami, Florida 33131

June 21, 2019

DearStockholder:

You are cordially invited to attendparticipate in the 2019 2022 Annual Meeting of Stockholders (the “Annual Meeting”“Meeting”) of WhiteHorse Finance, Inc. (the “Company”“Company,” “we,” “us” or “our”) to be held on August 1, 2019 4, 2022 at 12:00 p.m., Eastern Time, at the offices of Dechert LLP, located at 1095 Avenue of the Americas, 28thth Floor, New York, New York 10036.

The Notice of Annual Meeting of Stockholders and the proxy statement, which are accessible on the Internet or by request, provide an outline of the business to be conducted at the Annual Meeting. At the Annual Meeting, you will be asked to: (1) elect two directors of the Company and (2) ratify the selection of Crowe LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019.2022. I will also report on the Company’s progress during the past year and respond to stockholders’ questions.

Itisveryimportantthatyoursharesberepresentedatthe Annual Meeting. Even if you plan to attend the Annual Meeting in person, I urge you to follow the instructions on the Notice of Internet Availability of Proxy Materials to vote your proxy on the Internet. We encourage you to vote via the Internet, if possible, as it saves the Company significant time and processing costs. On the Notice of Internet Availability of Proxy Materials, you also will find instructions on how to request a hard copy of the proxy statement and proxy card free of charge, and you may vote your proxy by returning a proxy card to us after you request the hard copy materials. Your vote and participation in the governance of the Company are very important to us.

Sincerelyyours,

StuartAronson

Chief Executive Officer

Thisisanimportantmeeting.Toensureproperrepresentationatthe meeting, Meeting,pleasefollowtheinstructionson theNoticeofInternetAvailabilityofProxyMaterialstovoteyourproxyviatheInternetorrequest,complete, sign,dateandreturnaproxycard.Evenifyouvoteyoursharespriortothe meeting, Meeting,youmaystill may attend the meeting and vote your shares participatein person theMeetingandvoteyoursharesattheMeetingifyouwishtochangeyourvote.

WHITEHORSE FINANCE, INC.

1450 Brickell Avenue, 31stFloor

Miami, Florida 33131

(305) 381-6999

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 1, 2019

Notice is hereby given to the owners of shares of common stock (the “Stockholders”) of WhiteHorse Finance, Inc. (the “Company”“Company,” “we,” “us” or “our”) that:

The 20192022 Annual Meeting of Stockholders (the “Annual Meeting”“Meeting”) of the Company will be held at the offices of Dechert LLP, located at 1095 Avenue of the Americas, 28thth Floor, New York, New York 10036, on August 1, 20194, 2022 at 12:00 p.m., Eastern Time, for the following purposes:

1.

2.

You have the right to receive notice of, and to vote at, the Annual Meeting if you were a Stockholder of record atthecloseofbusinessonJune6,2022(the“RecordDate”).AlistofstockholdersofrecordasoftheRecord Date will be available for inspection for any purpose germane to the Meeting during ordinary business hours at our offices located at 1450 Brickell Avenue, 31stFloor, Miami, Florida 33131 for a period of 10days prior to the closeMeeting. If, as a result of business on June 6, 2019. the COVID-19 pandemic, our offices are not generally open, stockholders may request access to the list of stockholders by contacting us by mail sent to the attention of theSecretaryoftheCompanyatourprincipalexecutiveofficeslocatedat1450BrickellAvenue,31st Floor, Miami, Florida 33131 or you can call us by dialing (305) 381-6999, in each case stating the purpose of the request and providing proof of ownership of the Company’s stock. The list of stockholders will also be available for inspection during the Meeting through the meetingwebsite.

We are furnishing proxy materials to our Stockholders of record on the Internet, rather than mailing printed copies of those materials to each such Stockholder.Stockholders. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials unless you request them. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review the proxy materials, and vote your proxy, on theInternet.

Your vote is extremely important to us. If you are unable to attendparticipate in the Annual Meeting, we encourage you to vote your proxy on the Internet by following the instructions provided on the Notice of Internet Availability of Proxy Materials. You may also request from us, free of charge, hard copies of the proxy statement and a proxy card by following the instructions on the Notice of Internet Availability of Proxy Materials. In the event there are not sufficient votes for a quorum or to approve the proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies by the Company.

THE BOARD OF DIRECTORS OF THE COMPANY, INCLUDING EACH OF THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR EACH OF THE PROPOSALS.

By Order of | |||||

Richard Siegel

Secretary

Miami, Florida

June 23, 2022

Thisisanimportantmeeting.ToensureproperrepresentationattheMeeting,pleasefollowtheinstructionson theNoticeofInternetAvailabilityofProxyMaterialstovoteyourproxyviatheInternetorrequest,complete, sign,dateandreturnaproxycard.Evenifyouvoteyoursharespriortothe Annual Meeting,youstillmay attend the Annual Meeting and vote your shares participatein person theMeetingandvoteyoursharesattheMeetingifyouwishtochangeyourvote.

WHITEHORSE FINANCE, INC.

1450 Brickell Avenue, 31st Floor

Miami, Florida 33131 (305) 381-6999

PROXY STATEMENTFor2019

FOR

2022 Annual Meeting of Stockholders

To Be Held on August 1, 2019

Thisdocumentwillgiveyoutheinformationyouneedtovoteonthematterslistedontheaccompanying Notice of Annual Meeting of Stockholders (“Notice(the “Notice of Annual Meeting”). Much of the information in this proxy statement (“(this “Proxy Statement”) is required under rules of the U.S. Securities and Exchange Commission (“SEC”(the “SEC”), and some of it is technical in nature. If there is anything you do not understand, please contact us at (305)381-6999.

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of WhiteHorse Finance, Inc. (the “Company,“Company,” “WhiteHorse “WhiteHorse Finance,” “we,“we,” “us”“us” or “our”) for use at our 20192022 Annual Meeting of Stockholders (the “Annual Meeting”“Meeting”) to be held on Thursday, August 1, 2019 4, 2022 at 12:00 p.m., Eastern Time at the offices of Dechert LLP, located at 1095 Avenue of the Americas, 28thth Floor, New York, New York 10036, and at any postponements or adjournments thereof.thereof. This Proxy Statement and the Company’s annual report on Form 10-K (the “Annual “Annual Report”) for the fiscal year endedDecember31, 2018 2021arebeingprovidedtostockholders (“oftheCompany(the“Stockholders”)of the Company of record as of June 6, 20192022 (the “Record Date”) via the Internet on or about June 21, 2019.23, 2022. In addition, a Notice of Annual Meeting and a Notice of Internet Availability of Proxy Materials are being sent to Stockholders of record as of the RecordDate.

We encourage you to vote your shares, either by voting in person at the Annual Meeting or by voting by proxy, whichmeansthatyouauthorizesomeoneelsetovoteyourshares.Sharesrepresentedbydulyexecutedproxies will be voted in accordance with your instructions. If you execute a proxy without specifying your voting instructions, your shares will be voted in accordance with the Board’s recommendation. If any otherbusiness is brought before the Annual Meeting, your shares will be voted at the Board’s discretion unless you specifically state otherwise on yourproxy.

You may revoke a proxy at any time before it is exercised by notifying the Company’s Secretary in writing, by submitting a properly executed, later-dated proxy or by voting in person at the Annual Meeting. Any Stockholder entitled to vote at the Annual Meeting may attendparticipate in the Annual Meeting and vote in person, whether or not he, she or sheit has previously voted his, her or herits shares via proxy or wishes to change a previous vote.

You will be eligible to vote your shares electronically via the Internet, by telephone or by mail by following the instructions on the Notice of Internet Availability of Proxy Materials.

Purpose of Annualthe Meeting

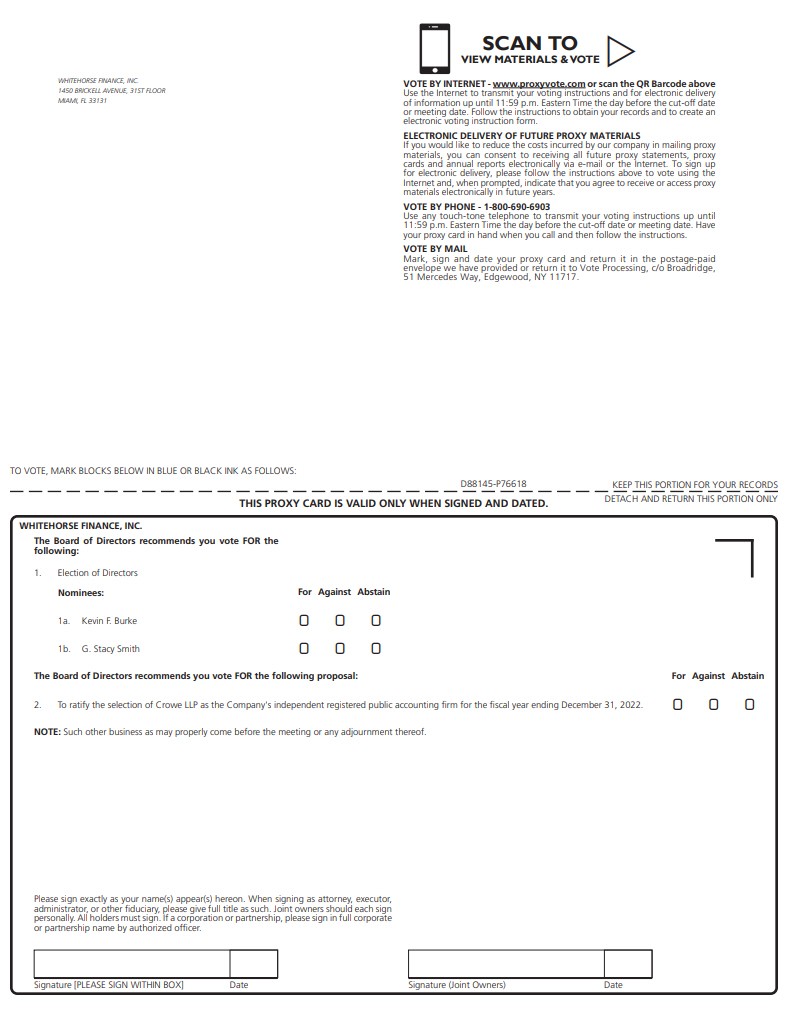

At the Annual Meeting, you will be asked to vote on the following proposals (the “Proposals”):

| 1. | To elect two Class I directors of the Company who will serve until the 2025 annual meeting of Stockholders or until their successors are duly elected and qualify (“Proposal 1”);and |

| 2. | To ratify the selection of Crowe LLP (“Crowe”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 (“Proposal 2”). |

Voting Securities

You may vote your shares at the Annual Meeting only if you were a Stockholder of record at the close of business on the Record Date. There were 20,546,03223,243,088 shares of common stock, par value $0.001 per share (“Common Stock”) outstanding on the Record Date. Each share of Common Stock is entitled to one vote.

1

Quorum Required

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of Common Stock outstanding which are entitled to vote on the Record Date will constitute a quorum. Abstentions will be treated as shares that are present for purposes of determining the presence of a quorum for transacting business at the Annual Meeting.Sharesheldbyabrokerorothernomineeforwhichthenomineehasnotreceivedvotinginstructions from the record holder and does not have discretionary authority to vote the shares on non-routine proposals are considered “broker non-votes” with respect to such proposals. However, because Proposal 2 is a routine matter, broker non-votes will be treated as shares that are present for quorum purposes at the Annual Meeting. Therefore, a broker non-vote will make a quorum more readilyattainable.

Votes Required

Election of Directors

The election of a director requires the affirmative vote of a majority of the votes cast by Stockholders entitled to vote at the Annual Meeting in person or by proxy and entitled to vote.proxy. Stockholders may not cumulate their votes. Abstentions will not be included in determining the number of votes cast and, as a result, will have no effect on this Proposal.

Ratification of Selection of Independent Registered Public Accounting Firm

The ratification of the selection of Crowe requires the affirmative vote of a majority of the votes cast by Stockholders entitled to vote at the Annual Meeting in person or by proxy and entitled to vote. proxy. Stockholders may not cumulate their votes. Abstentions will not be included in determining the number of votes cast and, as a result, will have no effect on this Proposal.

Broker Non-Votes

Broker non-votes are described as votes cast by a broker or other nominee on behalf of a beneficial holder who does not provide explicit voting instructions to such broker or nominee and who does not attendparticipate in the Annual Meeting. Proposal 1, the election of two Class I directors, is a non-routine matter. As a result, if you hold shares in “street name” through a broker, bank or other nominee, your broker, bank or nominee will not be permitted to exercise voting discretion with respect to Proposal 1. Therefore, if you do not give your broker or nominee specific instructions on how to vote for you or you do not vote for yourself via the Internet by returning a proxy card or by other arrangement with your broker or nominee, then your shares will have no effect on Proposal 1.

Proposal 2, the ratification of the selection of Crowe to serve as the Company’s independent registered public accounting firm, is a routine matter. As a result, if you beneficially own your shares and you do not provide your broker or nominee with proxy instructions, either by voting in accordance with the voting instructions on the proxy card, by returning a proxy card or by other arrangement with your broker or nominee, then your broker or nominee will be able to vote your shares for you on Proposal 2.

2

Adjournment and Additional Solicitation

IftherearenotenoughvotestoestablishaquorumortoapprovetheProposalsatthe Annual Meeting,then eitherthepresidingofficerofthe Annual MeetingortheStockholderswhoarerepresentedin personorbyproxy mayvotetoadjournthe Annual Meetingtopermitfurthersolicitationofproxies.MarcoCollazosand Edward J. Giordano JoysonC. ThomasarethepersonsnamedasproxiesfortheCompanyandwillvoteproxiesheldbythemforan adjournment,topermitthefurthersolicitationofproxiesforpurposesofestablishingaquorum.

A Stockholder vote may be taken on any of the Proposals in this Proxy Statement prior to any such adjournment if there are sufficient votes for approval of such Proposal.

Information Regarding This Solicitation

The Company will bear the expense of the solicitation of proxies for the Annual Meeting, including the cost of preparing and posting this Proxy Statement and the Annual Report to the Internet and the cost of mailing the Notice of Annual Meeting, the Notice of Internet Availability of Proxy Materials and any requested proxy materials to Stockholders. The Company intends to use the services of Broadridge Financial Solutions, Inc., a leading provider of investor communications solutions, to aid in the distribution and collection of proxy votes. The Company expects to pay market rates for such services. The Company reimburses brokers, trustees, fiduciaries and other institutions for their reasonable expenses in forwarding proxy materials to the beneficial owners and soliciting them to executeproxies.

In addition to the solicitation of proxies by use of the Internet, proxies may be solicited in person and/or by telephone, mail or facsimile transmission by directors or officers of the Company, officers or employeesof H.I.G.WhiteHorseAdvisers,LLC,theCompany’sinvestmentadviser (“(“WhiteHorseAdvisers”), H.I.G.WhiteHorseAdministration,LLC,theCompany’sadministrator (“(“WhiteHorseAdministration”), and/orbyaretainedsolicitor.Noadditionalcompensationwillbepaidtosuchdirectors,officersorregular employeesforsuchservices.IftheCompanyretainsasolicitor,theCompanyhasestimatedthatitwould payapproximately $30,000 $30,000forsuchservices.IftheCompanyengagesasolicitor,youcouldbecontactedby telephoneonbehalfoftheCompanyandurgedtovote.Thesolicitorwillnotattempttoinfluencehow youvoteyourshares,butonlyaskthatyoutakethetimetocastavote.Youmayalsobeaskedifyouwould liketovoteoverthetelephoneandtohaveyourvotetransmittedtoourproxytabulationfirm.The address of each of WhiteHorse Advisers and WhiteHorse Administration is 1450 Brickell Avenue, 31ststFloor, Miami, Florida 33131.

Stockholders may provide their voting instructions through the Internet, by telephone or by mail by following the instructions on the Notice of Internet Availability of Proxy Materials. These options require Stockholders to input the control number, which is provided within the Notice of Internet Availability of Proxy Materials. If you vote using the Internet, after visiting www.proxyvote.com and inputting your control number, you will be prompted to provide your voting instructions. Stockholders will have an opportunity to review their voting instructions and make any necessary changes before submitting their voting instructions and terminating their Internet link. Stockholders that vote via the Internet, in addition to confirming their voting instructions prior to submission, will, upon request, receive an e-mail confirming their instructions.

If a Stockholder wishes to participate in the Annual Meeting but does not wish to give a proxy by the Internet, theStockholdermay attend jointhe Annual Meeting in personMeetingorrequestandsubmitaproxycardbyfollowingtheinstructions on the Notice of Internet Availability of ProxyMaterials.

Any proxy authorized pursuant to this solicitation may be revoked by notice from the person giving the proxyatanytimebeforeitisexercised.Arevocationmaybeeffectedbyresubmittingvotinginstructionsvia the Internet voting site, by telephone, by obtaining and properly completing another proxy card that is dated later than the original proxy card and returning it, by mail, in time to be received before the Annual Meeting, by attendingparticipating in the Annual Meeting and voting in person, or by a notice, provided in writing and signed by the Stockholder, delivered to the Company’s Secretary on any business day before the date of the Annual Meeting.

3

Security Ownership of Certain Beneficial Owners and Management

As of the Record Date, to our knowledge, there are no persons who would be deemed to “control” us, as such term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”).

Ourdirectorsincludethreeinteresteddirectorsandfourindependentdirectors.Aninteresteddirector isan “interested “interestedperson”oftheCompany,asdefinedinthe1940Act,andindependentdirectorsareall otherdirectors (the “Independent (the“IndependentDirectors”).Messrs.KevinF.Burke,RickP.Frier,RickD.Puckett,and G. Stacy Smith qualify as Independent Directors.

Thefollowingtablesetsforth,asofJune 18, 2019, 6,2022,certainownershipinformationwithrespecttoour Common Stockforthosepersonswhodirectlyorindirectlyown,controlorholdwiththepowertovote, fivepercentormoreofouroutstandingCommon Stockandallofficersanddirectors,individuallyandasa group.AsofJune6,2022,therewere23,243,088sharesofCommon Stockoutstanding.

Security Ownership of Certain Beneficial Owners and all officers and directors, individually and as a group. As of June 18, 2019, there were 20,546,032 shares of Common Stock outstanding.

| | | | Type of Ownership | | | Of Common Stock outstanding | | ||||||||||||

| Name and Address | | | Shares Owned | | | Percentage | | ||||||||||||

H.I.G. Bayside Debt & LBO Fund II, L.P.(1) | | | | | Beneficial | | | | | | 4,507,204 | | | | | | 21.9% | | |

H.I.G. Bayside Loan Opportunity Fund II, L.P.(1) | | | | | Beneficial | | | | | | 3,672,796 | | | | | | 17.9% | | |

Hamilton Lane Advisors, L.L.C.(2) | | | | | Beneficial | | | | | | 1,075,244 | | | | | | 5.2% | | |

Stuart Aronson(3) | | | | | Beneficial | | | | | | 18,000 | | | | | | * | | |

John Bolduc(3)(4) | | | | | Beneficial | | | | | | 191,975 | | | | | | * | | |

Jay Carvell(3) | | | | | Beneficial | | | | | | 15,629 | | | | | | * | | |

Sami Mnaymneh(5)(6) | | | | | Beneficial | | | | | | 8,466,697 | | | | | | 41.2% | | |

Anthony Tamer(5)(7) | | | | | Beneficial | | | | | | 8,456,117 | | | | | | 41.2% | | |

Kevin F. Burke(3) | | | | | Beneficial | | | | | | 7,530 | | | | | | * | | |

Rick P. Frier(3) | | | | | Beneficial | | | | | | — | | | | | | * | | |

Rick D. Puckett(3)(8) | | | | | Beneficial | | | | | | 18,912 | | | | | | * | | |

G. Stacy Smith(3) | | | | | Beneficial | | | | | | — | | | | | | * | | |

Marco Collazos(3) | | | | | Beneficial | | | | | | — | | | | | | * | | |

Edward J. Giordano(3) | | | | | Beneficial | | | | | | — | | | | | | * | | |

| All officers and directors as a group (9 persons) | | | | | Beneficial | | | | | | 252,046 | | | | | | 1.2% | | |

| | | | | | | |

|

| Type of |

| Shares |

| |

|

Name and Address | | Ownership | | Owned | | Percentage |

|

H.I.G. Bayside Loan Opportunity Fund IV, L.P.(1) |

| Beneficial |

| 4,976,258 |

| 21.4 | % |

Stuart Aronson(2) |

| Beneficial |

| 36,000 |

| | * |

John Bolduc(2)(3) |

| Beneficial |

| 316,000 |

| 1.4 | % |

Jay Carvell(2) |

| Beneficial |

| 15,630 |

| | * |

Sami Mnaymneh(4)(5) |

| Beneficial |

| 5,379,890 |

| 23.1 | % |

Anthony Tamer(4)(6) |

| Beneficial |

| 5,373,870 |

| 23.1 | % |

Kevin F. Burke(2) |

| Beneficial |

| 7,530 |

| | * |

Rick P. Frier(2)(8) |

| Beneficial |

| 3,700 |

| | * |

Rick D. Puckett(2)(7) |

| Beneficial |

| 19,912 |

| | * |

G. Stacy Smith(2) |

| Beneficial |

| 3,700 |

| | * |

Marco Collazos(2) |

| Beneficial |

| 10,000 |

| | * |

Joyson C. Thomas(2) |

| Beneficial |

| 11,220 |

| | * |

All officers and directors as a group (9 persons) |

| Beneficial |

| 423,692 |

| 1.8 | % |

* | Represents less than 1.0%. |

| (1) | The address of H.I.G. Bayside Loan Opportunity Fund IV, L.P., a Delaware limited partnership, is 1450 Brickell Avenue, 31st Floor, Miami, Florida 33131. The number of shares of Common Stock shown in the above table as being owned by H.I.G. Bayside Loan Opportunity Fund IV, L.P. reflects the fact it may be viewed as having investment power over 4,976,258 shares of our Common Stock indirectly owned of record by such entity, although voting rights to such securities have been passed through to the respective limited partners. H.I.G. Bayside Loan Opportunity Fund IV, L.P. disclaims beneficial ownership of such shares of Common Stock, except to the extent of its pecuniary interests therein. |

| (2) | The address for each of our officers and directors is c/o WhiteHorse Finance, Inc., 1450 Brickell Avenue, 31st Floor, Miami, Florida 33131. |

| (3) | Mr. Bolduc is the sole shareholder of the general partner of Bolduc Family L.P. The number of shares of Common Stock shown in the above table as being owned by Mr. Bolduc reflects the fact that, due to his control of Bolduc Family, L.P., Mr. Bolduc may be viewed as having investment power over 158,854 shares of Common Stock owned by such entity. Mr. Bolduc disclaims beneficial ownership of shares of Common Stock held by Bolduc Family, L.P., except to the extent of his direct pecuniary interest therein. |

| (4) | Messrs. Mnaymneh and Tamer are control persons of H.I.G.-GP II, Inc., which is the manager of the general partner of H.I.G. Bayside Loan Opportunity Fund IV, L.P. The number of shares of Common Stock shown in the above table as being owned by each named individual reflects the fact that, due to their control of such entities, each may be viewed as having investment power over 4,976,258 shares of Common Stock indirectly owned by such entities, although voting rights to such securities have been passed through to the respective members and limited partners. Messrs. Mnaymneh and Tamer disclaim beneficial ownership of such shares of Common Stock except to the extent of their respective pecuniary interests therein. The address for each of Messrs. Mnaymneh and Tamer is c/o H.I.G. Capital, L.L.C., 1450 Brickell Avenue, 31st floor, Miami, Florida 33131. |

| (5) | Mr. Mnaymneh is the General Partner and Manager of Mnaymneh H.I.G. Management, L.P. The number of shares of Common Stock shown in the above table as being owned by Mr. Mnaymneh reflects the fact that, due to his control of Mnaymneh H.I.G. Management, L.P., Mr. Mnaymneh may be viewed as having investment power over 403,632 shares of |

4

| Common Stock owned by such entity. Mr. Mnaymneh disclaims beneficial ownership of shares of Common Stock held by Mnaymneh H.I.G. Management, L.P., except to the extent of his direct pecuniary interest therein. |

| (6) | Mr. Tamer is the President of Tamer H.I.G. Management, L.P. The number of shares of Common Stock shown in the above table as being owned by Mr. Tamer reflects the fact that, due to his control of Tamer H.I.G. Management, L.P., Mr. Tamer may be viewed as having investment power over 388,943 shares of Common Stock owned by such entity. Mr. Tamer disclaims beneficial ownership of shares of Common Stock held by Tamer H.I.G. Management, L.P., except to the extent of his direct pecuniary interest therein. |

| (7) | Mr. Puckett is a member of the Jen and Rick Puckett Foundation. The number of shares of Common Stock shown in the above table as being owned by Mr. Puckett reflects the fact that, due to his control of the Jen and Rick Puckett Foundation, Mr. Puckett has shared voting and dispositive power over 19,912 shares of Common Stock owned by such entity. |

| (8) | Mr. Frier is the grantor of the Rick P Frier Revocable Trust Dated 12/30/2015. The number of shares of Common Stock shown in the above table as being owned by Mr. Frier reflects the fact that, due to his control of the Rick P. Frier Revocable Trust Dated 12/30/2015, Mr. Frier may be viewed as having dispositive power over 3,700 shares of Common Stock owned by such entity. |

Dollar Range of Securities Beneficially Owned by Directors

The following table sets forth the dollar range of our equity securities beneficially owned by each of our directors as of June 18, 2019.6, 2022. We are not part of a “family of investment companies,” as that term is defined in Schedule 14A.

| | | | ||

| | | |||

Name of Director | | Dollar Range of Equity Securities in | |||

Independent Directors | | ||||

Kevin F. Burke | | | Over $100,000 | ||

Rick P. Frier | | $50,001 - $100,000 | |||

Rick D. Puckett | | Over $100,000 | |||

G. Stacy Smith | | $50,001 - $100,000 | |||

Interested Directors | | ||||

Stuart Aronson | | Over $100,000 | |||

John Bolduc | | Over $100,000 | |||

Jay Carvell | | Over $100,000 | |||

(1)

5

![[MISSING IMAGE: tv523880_pc1.jpg]](https://capedge.com/proxy/DEF 14A/0001144204-19-031888/tv523880_pc1.jpg)

![[MISSING IMAGE: tv523880_pc2.jpg]](https://capedge.com/proxy/DEF 14A/0001144204-19-031888/tv523880_pc2.jpg)

![[MISSING IMAGE: tv523880_pc3.jpg]](https://capedge.com/proxy/DEF 14A/0001144204-19-031888/tv523880_pc3.jpg)

![[MISSING IMAGE: tv523880_pc4.jpg]](https://capedge.com/proxy/DEF 14A/0001144204-19-031888/tv523880_pc4.jpg)

![[MISSING IMAGE: tv523880_pc5.jpg]](https://capedge.com/proxy/DEF 14A/0001144204-19-031888/tv523880_pc5.jpg)

![[MISSING IMAGE: tv523880_pc6.jpg]](https://capedge.com/proxy/DEF 14A/0001144204-19-031888/tv523880_pc6.jpg)